In this update, Laurence Slavin, discusses the July 2022 Review Body award, and why a 4.5% pay award without extra funding is NOT recommended! Also, Treasury response to request for help with 22/23 Annual Allowance charges, new residence online checker, and more! My name is Lauren Slavin. I’m a partner at Ramsey Brown LLP Chartered …

June 2022 Tax and Finance Update

In this broadcast, Laurence Slavin reviews the annual allowance problem, PCN Incorporations, Basis Period Reform and our Pension Info Report. My name is Lawrence Slavin. I’m a partner of Ramsay Brown Chartered Accountants and this is one of a series of broadcasts that we make to keep our clients and other people interested in what …

Tax and Finance Update April 2022

Updated Regulations for GP earnings, Spouses and Ltd Companies, Claiming Expenses for Employed Clinicians and Staff, Making Tax Digital is coming, and more!

New Pensions Review Service, Time to Act for Basis Period Reform, How NIC Changes Can Help You, Xero Recognition and More

This broadcast covers a new exciting pensions review report we are offering, plan now for basis period reform, how the Spring Statement can help you, Xero recognition and more!

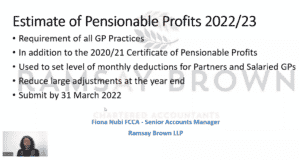

Estimate of Pensionable Profits 2022/23

In this broadcast, Senior Accounts Manager Fiona Nubi, reviews the requirement of all GP Practices to submit Estimate of Pensionable Profits 2022/23.

Response To Proposal To Reform General Practice – A Personal View

In this broadcast we discuss the latest report by the Policy Exchange.

Response To Proposal To Reform General Practice – A Personal ViewRead More

General Practice Contract Arrangements in 2022/23

In this broadcast, we briefly discuss the details of the General Practice Contract Arrangements for 2022/23.

25 November 2021 Update

This broadcast covers the latest news on the £150k GP declaration, Basis Period Reform and a review of VAT and Clinicians providing their services through a company.

Update (5 November 2021) to Basis Period Reform Broadcast on 28 October 2021)

This broadcast updates the earlier broadcast with more information on the issue of the Finance Bill and some helpful intervention from HMRC!

Update (5 November 2021) to Basis Period Reform Broadcast on 28 October 2021)Read More

Autumn Budget 2021 – Basis Period Reform may Significantly increase your Taxes (Update – 28 October 2021)

This broadcast explains how the tax Basis Period Reform could significantly increase tax charges for self-employed clients, GPs and Consultants.