In this update, Laurence Slavin, discusses the July 2022 Review Body award, and why a 4.5% pay award without extra funding is NOT recommended! Also, Treasury response to request for help with 22/23 Annual Allowance charges, new residence online checker, and more! My name is Lauren Slavin. I’m a partner at Ramsey Brown LLP Chartered …

Tax Free Benefits For Employees

Tax Free Benefits For Employees As an employer, you may provide your employees with benefits or pay expenses or reimburse them, but these expenses payments are not always taxable. Below are those expenses which are non taxable. ‘’Trivial’’ benefit in kind – That is less than £50 in value, not exchange for cash, not a …

June 2022 Tax and Finance Update

In this broadcast, Laurence Slavin reviews the annual allowance problem, PCN Incorporations, Basis Period Reform and our Pension Info Report. My name is Lawrence Slavin. I’m a partner of Ramsay Brown Chartered Accountants and this is one of a series of broadcasts that we make to keep our clients and other people interested in what …

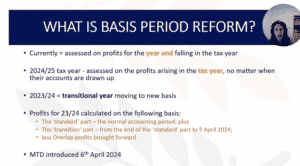

Basis Period Reform

Katie Collin explains the significant impact of basis period reform for non-March year-end partnerships, the impact on their tax and how to manage this significant change in reporting to HMRC.

Finance and Tax Update May 2022

Annual Allowance Horror, Our Pension Report, Basis Period Reform, Fraud, Practice Manager Partner, and more!

Tax and Finance Update April 2022

Updated Regulations for GP earnings, Spouses and Ltd Companies, Claiming Expenses for Employed Clinicians and Staff, Making Tax Digital is coming, and more!

An Exciting New Bespoke Pensions Information Report Service from Ramsay Brown!

Our new report will:– explain your likely pension benefits– explain your options for maximising the lump sum– consider the impact of taking your pension early– calculate the effect of any annual allowance and lifetime allowance charges,– show the impact of the McCloud Judgementand will help identify any errors in your pension record (PCSE have identified …

An Exciting New Bespoke Pensions Information Report Service from Ramsay Brown!Read More

New Pensions Review Service, Time to Act for Basis Period Reform, How NIC Changes Can Help You, Xero Recognition and More

This broadcast covers a new exciting pensions review report we are offering, plan now for basis period reform, how the Spring Statement can help you, Xero recognition and more!

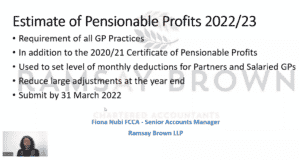

Estimate of Pensionable Profits 2022/23

In this broadcast, Senior Accounts Manager Fiona Nubi, reviews the requirement of all GP Practices to submit Estimate of Pensionable Profits 2022/23.

Year End Tax Planning

In this broadcast, Russell Finn will discuss some basic year end tax planning.